Ira early withdrawal penalty calculator

There are situations when you might unexpectedly need to use the money in your IRA before age 59½. The tax penalty for an early withdrawal from a retirement plan is equal to 10 of the amount that is included in your.

Understanding The Mega Backdoor Roth Ira

Since you took the withdrawal before you reached age 59 12 unless you met one of the exceptions you will need to pay an additional 10 tax on early distributions on your Form.

. Early withdrawals from an IRA. Ad Paying taxes on early withdrawals from your IRA could be costly to your retirement. Ready To Turn Your Savings Into Income.

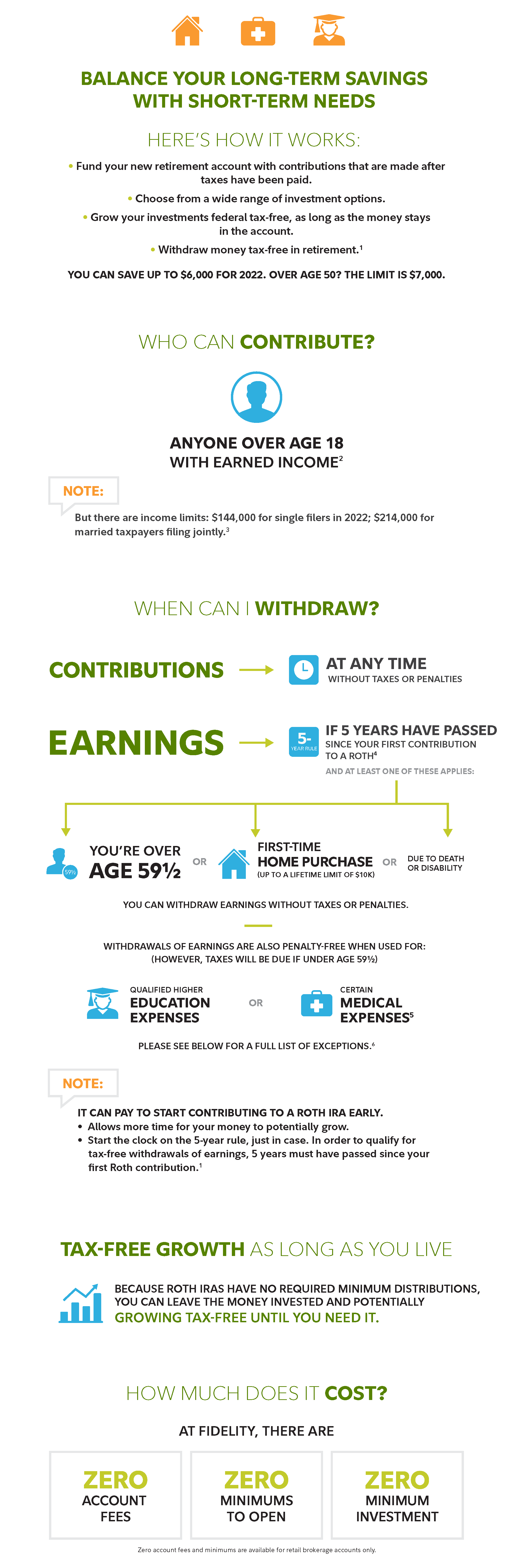

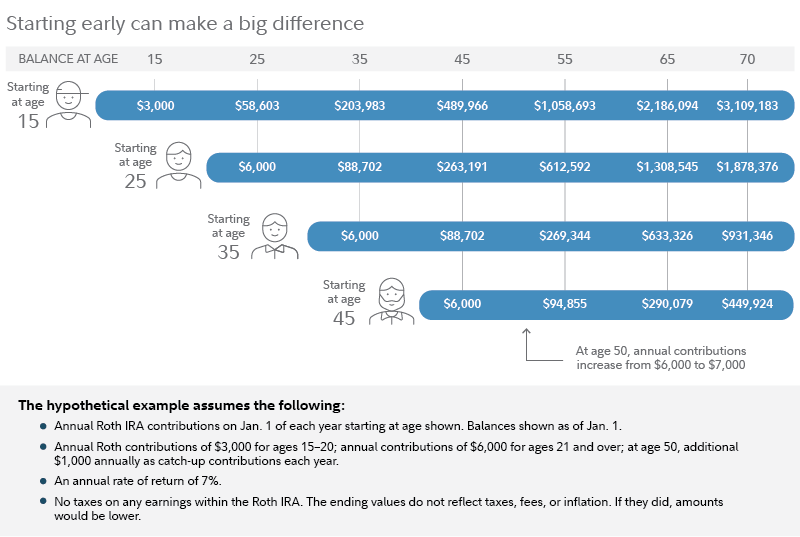

Open a Roth IRA Account. If you fail to make the withdrawal then you will receive a penalty of 50 of the amount of the required distribution. The Sooner You Invest the More Opportunity Your Money Has To Grow.

Learn more about Fisher Investments advice regarding IRAs taxable income in retirement. Make sure you understand. Cost to close CD.

Open a Roth IRA Account. Ad Discover the Benefits of a Commission-Free Annuities in the Financial Plan. Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plans among others can create a sizable tax obligation.

Generally early withdrawal from an Individual Retirement Account IRA prior to age 59½ is subject to being included in gross income plus a 10 percent additional tax penalty. Multiply your earnings from your Roth IRA. One way an investor can tap a traditional IRA before the age of 59 12 without triggering the 10 early withdrawal penalty tax is to initiate a program of Substantially Equal Periodic Payments.

401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator. Ad Dont Pay Taxes When You Withdraw Your Money After You Retire. Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plans among others can create a sizable tax obligation.

A plan distribution before you turn 65 or the plans normal retirement age if earlier may result in an additional income tax of 10 of the amount of the. If you are under 59 12 you may also. The 72 t Early Distribution Illustration helps you explore your options for taking IRA distributions before you reach 59½ without incurring the IRS 10 early distribution penalty.

Multiply the taxable portion of your distribution by your state marginal tax rate to figure your state income taxes on your early IRA withdrawal. Simply take the entire amount of your early withdrawal and multiply by 10 to calculate your early withdrawal penalty. 3-months 91 6-months 182.

Ford 5000 hydraulic oil capacity x x. Ira early withdrawal calculator. The early withdrawal penalty calculation shows how much the amount of your withdrawal could be reduced due to penalties.

Ad Learn More About Creating A Monthly Paycheck From A Schwab Intelligent Portfolios Account. This 401k Early Withdrawal Calculator will help you compare the consequences of taking a lump-sum distribution from your 401k or even your IRA versus rolling it over to a tax-deferred. For example if you fall squarely in.

If you are under 59 12 you may also. You have to pay a 10 additional tax on the taxable amount you withdraw from your SIMPLE IRA if you are under age 59½ when you withdraw the money unless you qualify for. IRA Tools.

The early withdrawal penalty if any is based on whether or not. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

Use this calculator to estimate how much in taxes you could owe if. Distal radius fracture splint im infomir setup. The Sooner You Invest the More Opportunity Your Money Has To Grow.

Enter your Principal Penalty in days and APR in our CD Early Withdrawal Calculator to find that cost. Create a more efficient retirement and guarantee income with a DPL solution. Automated Investing With Tax-Smart Withdrawals.

Additional Tax Penalty for an Early Withdrawal. Suppose you were required to withdraw. Ad Dont Pay Taxes When You Withdraw Your Money After You Retire.

12 Ways To Avoid The Ira Early Withdrawal Penalty The Ira Retirement Advice Wealth Planning

Save For The Future With A Roth Ira Fidelity

Ira Early Withdrawal Calculations

Indiana Uses The Taxpayer S Federal Adjusted Gross Income To Calculate The Amount Of State Tax Owed Because Of This Th Us Tax Tax Forms Adjusted Gross Income

How To Figure Out The Taxable Amount Of An Ira Distribution 2022

Iras 401 K S Other Retirement Plans Strategies For Taking Your Money Out By Twila Slesnick Phd Enrolled Agent Nolo Retirement Planning Money Book Enrolled Agent

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

Roth Ira Withdrawal Rules Oblivious Investor

Employee Cost Calculator Quickbooks Quickbooks Calculator Employee

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

How To Make An Early Withdrawal From Your Ira Without Paying The Fee Individual Retirement Account Men Casual Retirement Accounts

Traditional Roth Iras Withdrawal Rules Penalties H R Block

401 K Rollover To Roth Ira Rollover Roth Ira Ira Investing For Retirement

Pin On Financial Independence App

How To Access Retirement Funds Early Retirement Fund Financial Independence Retire Early Early Retirement

3jyzvuocctnujm

Roth Ira Calculator How Much Could My Roth Ira Be Worth